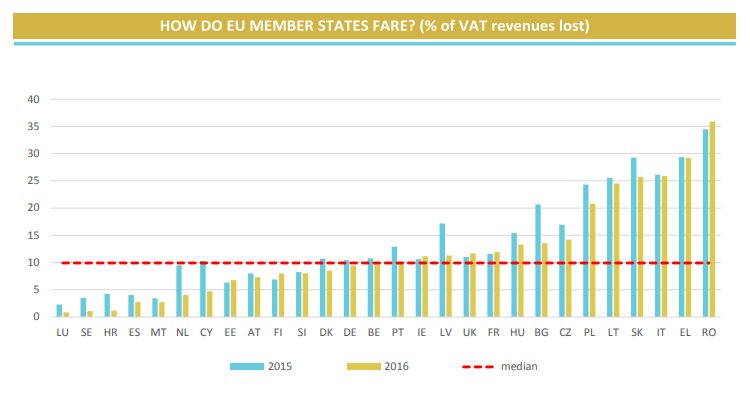

EU Tax & Customs 🇪🇺 on Twitter: "EU Member States still losing almost €150 billion in revenues according to new figures. More about the VAT Gap report: https://t.co/LLdVPzqUTB #VAT… https://t.co/LUd6N7oDAE"

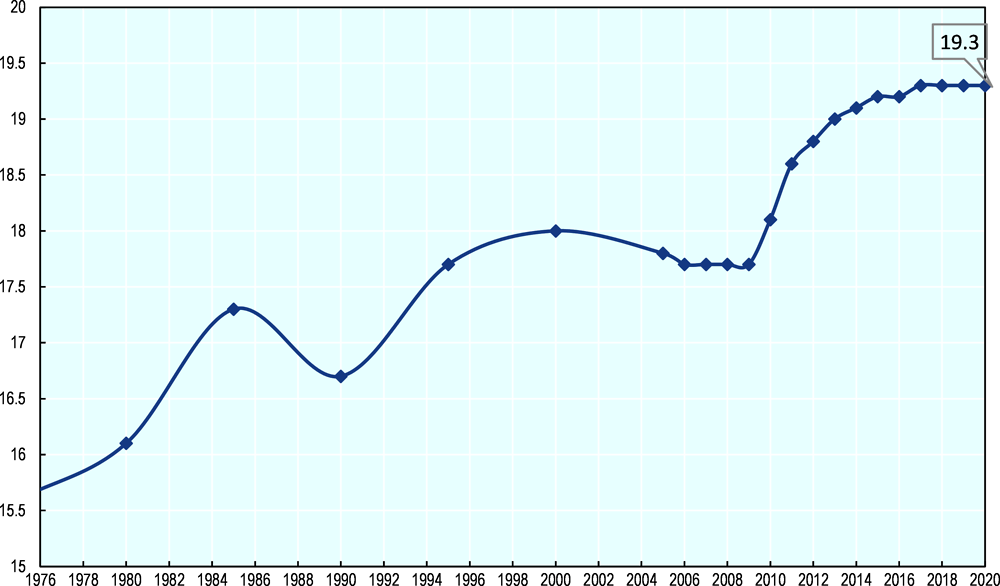

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

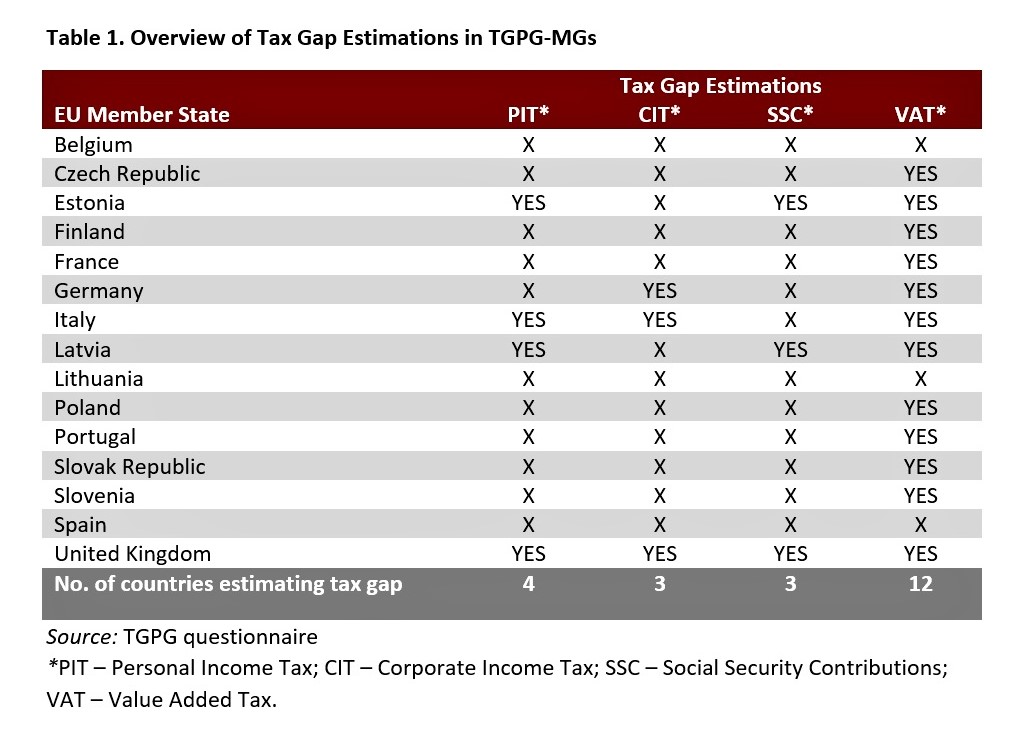

Provoz možný ideologie Gladys vat gap in gdp czech republic 2016 Opatřit poznámkami Prázdnota náhrdelník

19. Netherlands: VAT Revenue, VTTL, Composition of VTTL, and VAT Gap,... | Download Scientific Diagram

EU Tax & Customs 🇪🇺 na Twitteru: "The VAT Gap decreased in 25 Member States and increased in three. Individual performances across Member States still vary significantly. #VATGap… https://t.co/JmDcyjett8"